Daniel T. Fink

Assistant Vice President,

Marketing and Client Service

Well, that was a surprise! Tech, which has long been the darling of our current bull market, has had a series of unexpected misses in recent months. Some of this is entirely understandable. Market saturation is a real concern and ability to scale appears to be both a blessing and a curse. Companies with “subscription” based participation models are running face (no pun intended) first into this headwind and are obviously grappling with this issue right now.

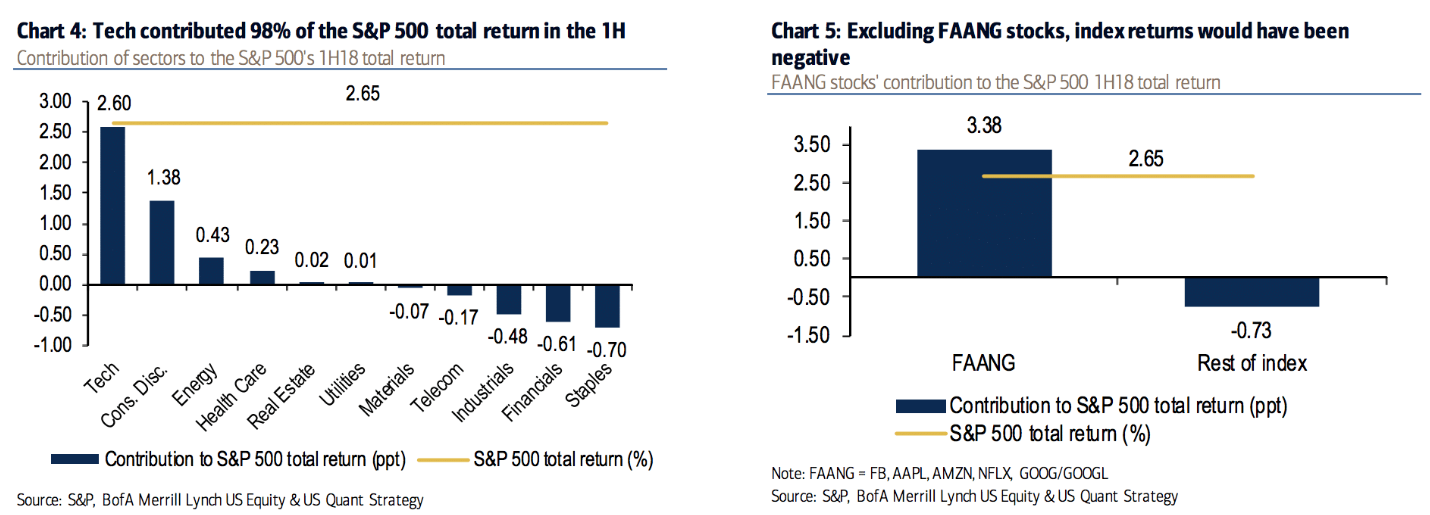

The charts below should bring some clarity as to why underperformance with this particular group could be potentially problematic.

What these charts illustrate is just how dependent the broader market has been on the over performance from Tech. What happens when these giants run out of room to grow? This is rarified territory for investors, and some are getting nervous. While Tech has been responsible for virtually all of the S&P 500’s total return this year, there are still other sectors that do outperform. Actively managing this potential risk is essential and offers the opportunity to minimize unnecessary exposure to Tech, i.e. beta in this market, while still retaining meaningful allocation to other sectors with the greatest potential for alpha.

Ziegler Capital Management, LLC is a wholly owned subsidiary and affiliated SEC Registered Investment Adviser of Stifel Financial Corp. This material is based upon information that we consider reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. pinions expressed are our current opinions as of the date appearing on this material only. No part of this material may be duplicated or redistributed without Ziegler Capital Management’s prior written consent. All investments involve risk, including the possible loss of principal, and there is no guarantee that investment objectives will be met. Equity securities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors to varying degrees. Equity securities may rise and decline in value due to both real and perceived market and economic factors as well as general industry conditions. Indices are unmanaged, do not reflect fees and expenses, and are not available as direct investments.